Uniform CPA Examination Structure

The Uniform CPA Examination is designed to assess the knowledge and skills required of newly licensed CPAs. It is made up of four sections. All candidates are required to complete three core sections: Auditing and Attestation (AUD), which covers auditing standards, procedures, and professional responsibilities; Financial Accounting and Reporting (FAR), which focuses on financial reporting frameworks for businesses, not-for-profits, and government entities; and Regulation (REG), which tests federal taxation, business law, and ethics. In addition to these core sections, candidates must select one discipline area to demonstrate specialized expertise. The three options are: Business Analysis and Reporting (BAR), which emphasizes advanced financial reporting, data analytics, and technical accounting topics; Information Systems and Controls (ISC), which focuses on IT governance, system controls, and cybersecurity risk management; and Tax Compliance and Planning (TCP), which concentrates on personal, business, and entity taxation, as well as strategic tax planning.

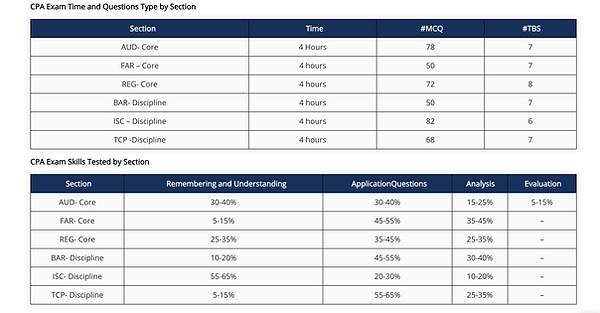

Candidates have a maximum of four and a half hours to complete the Examination: